Our Hawaii Wealth Management Process

A Comprehensive Approach to Growing & Protecting Your Wealth

Your wealth is complex. You have your investment portfolio, your taxes, your estate plan, your financial plan, and more. When these are out-of-sync, you could be missing out on portfolio returns, tax savings, and the peace of mind that comes with knowing your wealth is well-managed.

That's why our primary focus here at Hawaii Partners 3D Wealth Advisors is to serve our clients by coordinating each aspect of their wealth so that they can work in harmony with each other. When all your wealth is working together, for you, towards your goals, you place yourself in a much better position to achieve your dreams.

Made up of financial advisors, certified financial planners (CFP), certified public accountants (CPA) and more, our team aims to understand where you've been, where you are, and where you want to go. Then, we build a plan to get you there.

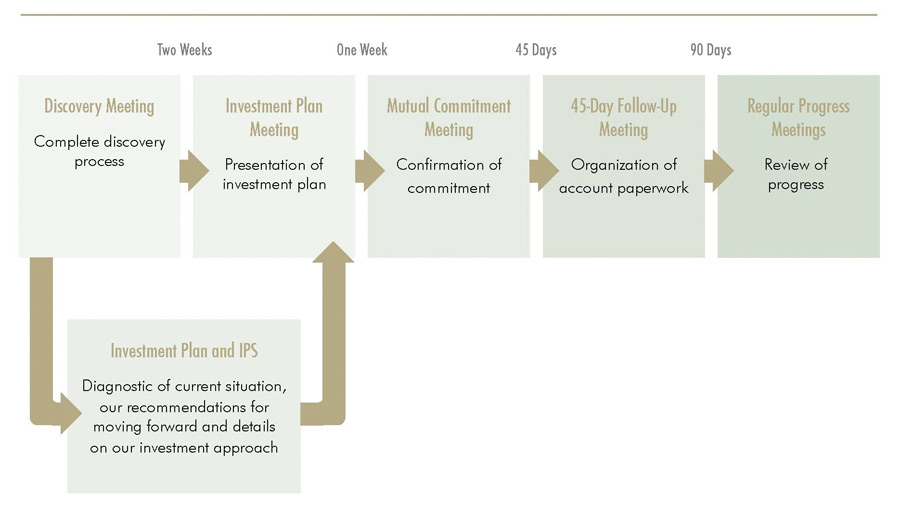

Step 1: Discovery Meeting

During the first meeting, the focus is on learning about you, your financial goals, and your current wealth management strategy.

After the meeting, our team integrates that information to create a wealth management strategy proposal. This proposal outlines our recommendation for improving your portfolio and achieving your financial goals.

Step 2: Analysis, Strategy, & Investment Planning Meeting

After you have reviewed the proposal, our next meeting is to talk about your opinions on the actions outlined on the proposal. We also discuss other potential strategies and investments based on your feedback on the initial proposal.

From there, you have the option of choosing whether or not to work with us.

Step 3: Mutual Commitment Meeting

If you decide to move forward with us, the next meeting contains the requisite paperwork to assign us as your Financial Advisor.

After the meeting - and pending your approval - our team will implement the agreed-upon investment strategy inside your portfolio.

Step 4: Implementation Follow-Up Meeting

After about 45 days, we would like to have a check-in to follow-up on the initial investment strategy and to begin to draft the bigger-picture tax strategy and financial plan.

From here, your personal financial advisor will send you updates about your account, recommendations for additional investment action, and other information relating to your specifically outlined goals and objectives.

Step 5: Monitoring & Progress Meetings

At the 90-day mark, your new wealth management process will be fully up-and-running.

Your advisor will contact you quarterly (or more or less frequently, depending on your preferences) to arrange a time for a portfolio review and to run through the current status of your financial plan, recommending changes as needed.

As a distinguished client, you are always encouraged to reach out to your advisor to set up a call, meeting, or video conference to discuss any wealth-related questions, concerns, or ideas.

Are you confident in your wealth management plan?

If your current wealth management plan is working well for you, then that is great! If you are wondering whether or not there is something you could be doing to better organize your wealth, we welcome the opportunity to provide you a second opinion.

Our second opinion service is a no-cost, no-obligation look at your current wealth management strategy, identifying and recommending areas where there may be opportunities to improve.

If you are interested in learning more about a second opinion, you can give us a call at (808) 791-1444 or fill out the form below and an advisor will reach out to you shortly.